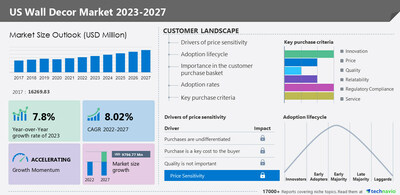

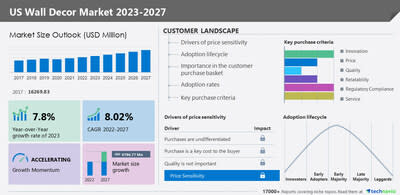

NEW YORK, May 1, 2023 /PRNewswire/ — Recent market research by Technavio estimates the US wall decoration market size to grow by USD 9,796.77 million from 2022 to 2027 at a CAGR of 8.02% It has been. The report also provides his five-year historical (2017-2021) data forecasts on market size, segmentation, and regions.Check out key insights on market size before purchasing the full report – Request a sample report

Technavio has published its latest market research report titled US Wall Decoration Market 2023-2027.

Qualitative and quantitative analysis of vendors was conducted to help clients understand the broader business environment and the strengths and weaknesses of key market players. The data is qualitatively analyzed to categorize vendors into pure-use, category-focused, industry-focused, and diversified. It is quantitatively analyzed and categorizes vendors into dominant, dominant, strong, tentative, and weak. Bargaining power of buyers and suppliers, threats of new entrants, competition, and substitutes are also analyzed and rated between low and high to provide an overall perspective of market favorability.

See Technavio's exclusive analysis of price sensitivity, adoption lifecycle, customer buying basket, adoption rate, and purchasing criteria.

One of the core elements of the customer landscape is price sensitivity, and analyzing it can help companies refine their marketing strategies and gain competitive advantage.

Another important aspect is the price sensitivity factor (purchase is not differentiated, purchase is an important cost to the buyer, quality is not important), which is low.

Additionally, market adoption rates for all regions are covered.

This market report also provides information on the inputs, research and development, capital expenditure, technology, and product importance of the 15 vendors listed below.

Amazon.com Inc.

Bed Bath and Beyond Co., Ltd.

Brewster Home Fashion

Costco Wholesale Co., Ltd.

Ethan Allen Interiors Co., Ltd.

F. Schumacher & Co.

Franchise Concepts Co., Ltd.

Haverty Furniture Companies, Inc.

Kimball International Co., Ltd.

Kirklands Co., Ltd.

kohls company

Lowe's Co., Ltd.

Macy's Co., Ltd.

Penny Opco LLC

Pier 1 Import Online Co., Ltd.

Restoration Hardware Co., Ltd.

Home Depot Co., Ltd.

Transform Holdco LLC

Walmart Co., Ltd.

Wayfair Co., Ltd.

williams sonoma company

story continues

Download the sample

Charts and data tables about market size, comparative analysis of segments, and year-on-year growth rate for the past five years (2017-2021) of the US Wall Decoration Market

The market is segmented by distribution channel (offline and online) and product (wall art, picture frames, wall clocks, and other decorative accents).

The offline segment is expected to account for a major share of the market growth during the forecast period. Offline stores allow customers to see the product in person before purchasing. Supermarkets and hypermarkets are the most popular distribution channels. The growth of supermarkets and hypermarkets is due to the growth of the organized retail sector in the United States. The retail store offers a variety of products under one roof. Manufacturers of wall decorations also sell their products in specialty stores and other retail formats. These factors will propel the growth of the segment during the forecast period.

Get the data – buy the report!

Market trend

Driving Forces – Improving living standards and introduction of premium products are driving the market growth. Due to lifestyle changes and increased disposable income, home renovations are becoming more popular in the United States. Demand for home renovations is also fueled by the growing demand for designer interior products, such as wall decoration items, and the proliferation of the internet and social media. Leading companies are expanding their portfolios by offering specialized products that meet various consumer demands. These factors will propel the market growth during the forecast period.

Trends – The increasing demand for interior design is a key trend in the market. The growth of the U.S. economy over the past five years has led to increased spending on home improvement and decorative products. Designer wall decorations such as wall art, wall clocks, and picture frames are in high demand. That's why interior designers and design companies introduce homeowners to investing in interior design. Rising awareness has further increased the demand for designer wall decorations. The increasing number of working women and their participation in household decision-making is also fueling demand for interior design. Such factors support the market growth during the forecast period.

Challenges – Increasing competition is making it difficult to grow the market. Manufacturers compete on aspects such as product portfolio, premiumization, differentiation, and pricing. Competition will further intensify during the forecast period due to the entry of new players and private brands. This creates price competition and further reduces product quality. Multichannel retailers have a lower cost structure, which also increases their maturity in the market. Therefore, changes in the competitive environment may affect the profit margins of the players, hindering the market growth during the forecast period.

View the PDF sample for key insights on market dynamics and segmentation.

Related reports:

The wallpaper market is estimated to grow at a CAGR of 4.7% from 2022 to 2027. The market size is projected to increase by US$ 5,493,960,000. This report segments the market by type (wall panels, tiles, metal wall coverings), by end user (residential and commercial), and by geography (APAC, North America, Europe, Middle East & Africa, South America) covers a wide range.

The US wallpaper market size is expected to increase by $9.21 billion from 2021 to 2026, and the market growth momentum is expected to accelerate at a CAGR of 5.44%. Additionally, the report extensively covers segmentation by end user (residential and commercial) and product type (wall panels, tiles, metal wall coverings).

Get instant access to over 17,000 market research reports covering 800 technologies from 50 countries.

Technavio's SUBSCRIPTION platform

What are the key data covered in this report?

CAGR of the market during the forecast period

Detailed information about the factors driving the growth of the US Wall Decoration Market from 2023 to 2027

Accurate estimation of US wall decoration market size and contribution to parent market

Accurate predictions about upcoming trends and changes in consumer behavior

US Wall Decoration Market Growth

Thorough analysis of the competitive landscape of the market and detailed information about vendors

Comprehensive analysis of factors hindering the growth of US Wall Decoration Market vendors

US wall decoration market size

Report scope

detail

base year

2022

historical era

2017-2021

Forecast period

2023-2027

Growth momentum and CAGR

Accelerating at a CAGR of 8.02%

Market Growth 2023-2027

$9,796.77 million

market structure

fragmented

YoY growth rate (%) for 2022-2023

7.8

competitive environment

Key vendors, vendor market position, competitive strategies, and industry risks

Introduction of major companies

Amazon.com Inc., Bed Bath and Beyond Inc., Brewster Home Fashions, Costco Wholesale Corp., Ethan Allen Interiors Inc., F. Schumacher and Co., Franchise Concepts Inc., Haverty Furniture Companies Inc., Kimball International Inc. , Kirklands Inc., Kohls Corp., Lowes Co. Inc., Macys Inc., Penney OpCo LLC, Pier 1 Imports Online Inc., Restoration Hardware Inc., The Home Depot Inc., Transform Holdco LLC, Walmart Inc., Wayfair Inc., and Williams Sonoma Inc.

Market trend

Parent market analysis, market growth drivers and obstacles, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis, future consumer trends, and market situation analysis for the forecast period.

Scope of customization

If the report doesn't contain the data you're looking for, you can contact an analyst to customize your segments.

Read Technavio's Consumer Discretionary Market Report

table of contents

1.executive summary

2 Market scenery

3 Determining market size

4 Past market size

5 Five Forces Analysis

6 Market segmentation by distribution channel

7 Market Segmentation by Product

8 Customer situation

9 drivers, challenges and trends

10 Vendor status

11 Vendor analysis

12 Appendix

About us

Technavio is the world's leading technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights that help companies identify market opportunities and develop effective strategies to optimize their market position. Offers. With over 500 expert analysts, Technavio's report library consists of over 17,000 reports covering 800 technologies across 50 countries, and growing. The company's customer base consists of companies of all sizes, including more than 100 Fortune 500 companies. This growing customer base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify existing and potential market opportunities and gain a competitive advantage within the changing market scenario. is evaluating its status.

contact

Technabio Research

jesse maida

Media and Marketing Executive

USA: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

US Wall Decoration Market 2023-2027

Sision

View original content to download multimedia: https://www.prnewswire.com/news-releases/wall-decor-market-in-us-to-grow-at-a-cagr- of-8-02-from-2022 -2027 Introducing premium products to improve living standards and drive growth—technavio-301810528.html

Source Technavio