The House passed a bill Thursday that would block the Biden administration from implementing new student loan repayment options tied to income.

The joint resolution under the Congressional Review Act disapproves of the Department of Education's rules that include family size and income in calculating the amount a borrower must repay. This option would allow borrowers making less than $15 an hour to pay $0.

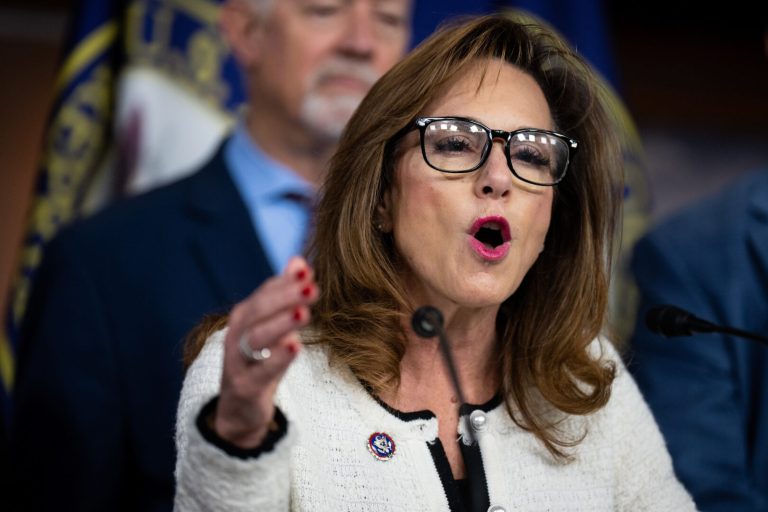

“This new regulation, ironically called the SAVE plan, is the most expensive regulation in our nation's history and is a backdoor attempt to shove the administration's socialist free college fantasy down the throats of hard-working taxpayers. ” Rep. Lisa McClain, R-Mich., said on the House floor ahead of Thursday's 210-189 vote. “This plan not only shifts the cost of the loan away from the borrower, the person who actually took out the loan, but also shifts that cost onto the person who never took out the loan in the first place, the taxpayer. You might even end up graduating.'' Higher. “

The government is forcing more borrowers to make hefty payments on their federal student loans, especially after the Supreme Court blocked President Joe Biden's attempt to cancel more than $400 billion in debt owed by former students in the wake of the pandemic. They argue that requiring the same would have broader economic consequences. The repayment suspension period has expired.

“This resolution will jeopardize a record economic recovery by reducing consumer spending for millions of borrowers who have returned to repayments after a three-year hiatus, especially low- and middle-income “It would be harmful to borrowers in the U.S. and community college students,” and borrowers in the public service,” the Office of Management and Budget said Monday in a statement of policy that the president would veto the measure.

The Senate voted 49-50 to reject the companion resolution to the House resolution before Thanksgiving. Sen. Tim Scott (R.C.) did not vote, but because the Biden administration opposes the bill and Vice President Kamala Harris will not vote to break a 50-50 The opposite would not have changed the outcome.

Before the Supreme Court issued its decision in June, the Senate sent Biden a separate measure authored by the House to block student loan forgiveness. Mr. Biden vetoed it, but the House of Representatives tried to override Mr. Biden's veto, but failed to secure the necessary two-thirds majority.

Separately, the government announced Wednesday that efforts to provide relief to student loan borrowers topped $4.8 billion. The Education Department said $2.6 billion in debt was forgiven for people in public sector jobs and $2.2 billion in relief from efforts to make income-based repayment programs work more effectively. Ta.

“We know there are many more student loan borrowers who have been bankrupted by this broken system and still need our help. We are working hard to fix the system. But we know there are many people who still need help,” Education Secretary Miguel Cardona told reporters Wednesday. “We have no intention of slowing down. Regulatory efforts are moving forward to provide much-needed relief to even more borrowers.”

The president echoed Cardona's comments in a statement.

“From day one of my administration, I vowed to improve our student loan system so that higher education provides opportunity and prosperity to Americans, rather than the unmanageable burden of student loan debt,” Biden said. “I will not back down from using every tool at our disposal to give student loan borrowers the relief they need to realize their dreams.”